Component Sense InPlant™ Solution: Turn E&O Stock Into Cash

By Kenny McGee, CEO of Component Sense.

Is your senior management team truly committed to driving down excess and obsolete (E&O) stock levels? Or are you stuck in a cycle of paralysis?

At Component Sense, we know the EMS world differently than anyone else. Since 2001, we have been selling excess stock, and we have seen the same barrier trip up major manufacturers time and time again: The Fear of Loss.

Whilst EMS companies were motivated to reduce the E&O, they couldn't take a financial loss on stock while it was still technically active in their system.

This differs within an OEM business. As soon as an OEM determines that the stock is obsolete to their requirements, they are prepared to dispose of it quickly, even if it means reducing the book value to achieve this.

If you bought a product for $1 and then sold it for $0.80, it feels like a failure. Consequently, you hold it. And hold it. Until it is worth $0.

We built the InPlant™ solution to break this cycle.

The Three Operational Obstacles That Kill Your E&O Value

We understand that you are not failing because of a lack of commitment; you are failing because the current processes are fundamentally flawed. We have seen multi-million lists, like a $50 million list of thousands of components, stall instantly due to three persistent operational obstacles:

1. The Inflated Cost Barrier

We regularly receive lists where we cannot move anything because the "standard cost" figure is unrealistic. It has been inflated by all kinds of extras, such as shipping, margin, and storage costs. This makes your stock more expensive than the market price before we even begin our work. If we cannot be competitive, we cannot sell.

2. The "Ghost Inventory" Nightmare

E&O stock in a volume business fluctuates constantly. You might have excess one day and none the next. By the time you cleanse, process, and send out your list, the stock has often been consumed by new forecasts. Your brokers invest huge effort to find a buyer only to discover the stock is no longer available. This broken trust prevents brokers from promoting your stock properly in the future.

3. The Manufacturer Part Number Gap

Most EMS companies work with internal part numbers that take little account of the manufacturer’s part number actually sitting on the shelf. We often receive lists with only ‘possible’ brands attached. When we find a buyer, close the deal, and then discover the wrong brand or part number is in the warehouse, it is embarrassing for us as a reseller. Nobody likes letting down a customer.

The Shotgun Approach: Why Multi-Broker Models Fail

Ultimately, these obstacles lead to bad practice. An EMS company often sends its list out to two, three, four, or sometimes ten brokers. This is meant to give maximum exposure, but as I know from my own experience:

-

Weakened Price: I can quickly scan the market and see up to 20 companies advertising a single part for the same EMS provider. This creates a false impression of abundance and dramatically weakens the sale price and your return.

-

Wasted Effort: Because every broker knows there is a high possibility of being let down or competing against 19 others, they cannot afford to put their heart and soul into selling your stock. This drives down the margin to the point that it doesn't cover their costs, and they simply stop quoting the stock altogether.

This process frustrates everybody involved, including your team. Sending out lists, fielding calls for part numbers, and ultimately generating little return is time-consuming and outdated.

I believe that this model needs to be replaced because it simply does not work.

How InPlant™ Solves the "Bad Data" Problem

The biggest obstacle to selling E&O stock isn't the market; it is your own data.

Most EMS companies work with internal part numbers. When you send a spreadsheet to a broker, it is full of "possible" matches or internal codes. A buyer cannot purchase a "maybe". They need to know the exact brand, part number, and date code.

Our InPlant™ solution fixes this from day one.

-

Live Integration: We link directly to your MRP (like SAP) to pull live data daily.

-

On-Site Verification: We place an operator (or train yours) with an InPlant™ iPad to verify stock physically.

-

Smart Filtering: If stock moves back into production, our system knows instantly. We do not market ghost inventory, and we do not waste your time re-counting the same parts.

The Maths: How We Return 100% of Your Cost

Because we do not have to buy the stock upfront, we operate on leaner margins than traditional brokers. Our goal is simple: Return 100% of your cost.

Because EMS companies of scale have superior buying power, you likely purchased your stock at a price well below the general market price. This gives us a massive opportunity.

The InPlant™ Profit Scenario:

Your Cost: $1.00

Market Price: $1.50

Our Sale Price: $1.10

We can sell the part for $1.10. This undercuts the market, making it an easy sale, but still returns 100% of your cash plus a 10% profit (PPV).

Our margin is small but because we adopt extremely lean processes and use technology and automation where possible we can cover the costs associated with selling your E&O.

Proven Success: From a $2B Trial to a Global Network

Our system is not a new experiment. We have been refining the InPlant™ process since 2012.

Our journey began with a massive $2 billion revenue site holding $50 million in excess stock. They faced every obstacle in the book: distinct business units with different margin requirements, complex customer contracts, and varying pricing structures (from Blackberry to Nokia).

We deployed version 1 of InPlant™ directly on their warehouse floor. The result? We turned static, "unmarketable" lists into live, clean data. We navigated the complex contract rules of each business unit and turned that $50 million headache into a revenue stream.

Today, InPlant™ is a fully refined, plug-and-play solution used by major EMS and OEM sites globally.

How InPlant™ Helped Corning Unlock Value from Excess Inventory

In 2022, Corning Inc. partnered with Component Sense to address its excess and obsolete inventory — not by discarding it, but by transforming it into real cash. They did this using the InPlant™ solution, which embeds Component Sense’s team directly on-site within Corning’s EMS facilities, allowing Corning to retain ownership and full visibility of their stock.

Remarkably, our InPlant™ service was up and running in just two weeks, ensuring the process did not disrupt Corning’s operations. Component Sense set realistic resale valuations based on real-time global market data, rather than inflated promises, and provided Corning with ongoing transparency through a user-friendly sales platform.

Because of this partnership, Corning redistributed over 2.5 million components rather than sending them to landfill. Between 2022 and 2025, they recovered more than US$1.55 million in cash.

As Bob Siamro, Manager of Global Manufacturing at Corning, put it:

“We were blown away by the returns, especially early on, when some components sold for more than what we originally paid.”

This reflects how InPlant™ helped Corning reframe E&O inventory from a liability into a strategic, cash-generating asset.

The Network Effect: You Are Not Alone

When you join InPlant™, you are plugging into a trusted ecosystem.

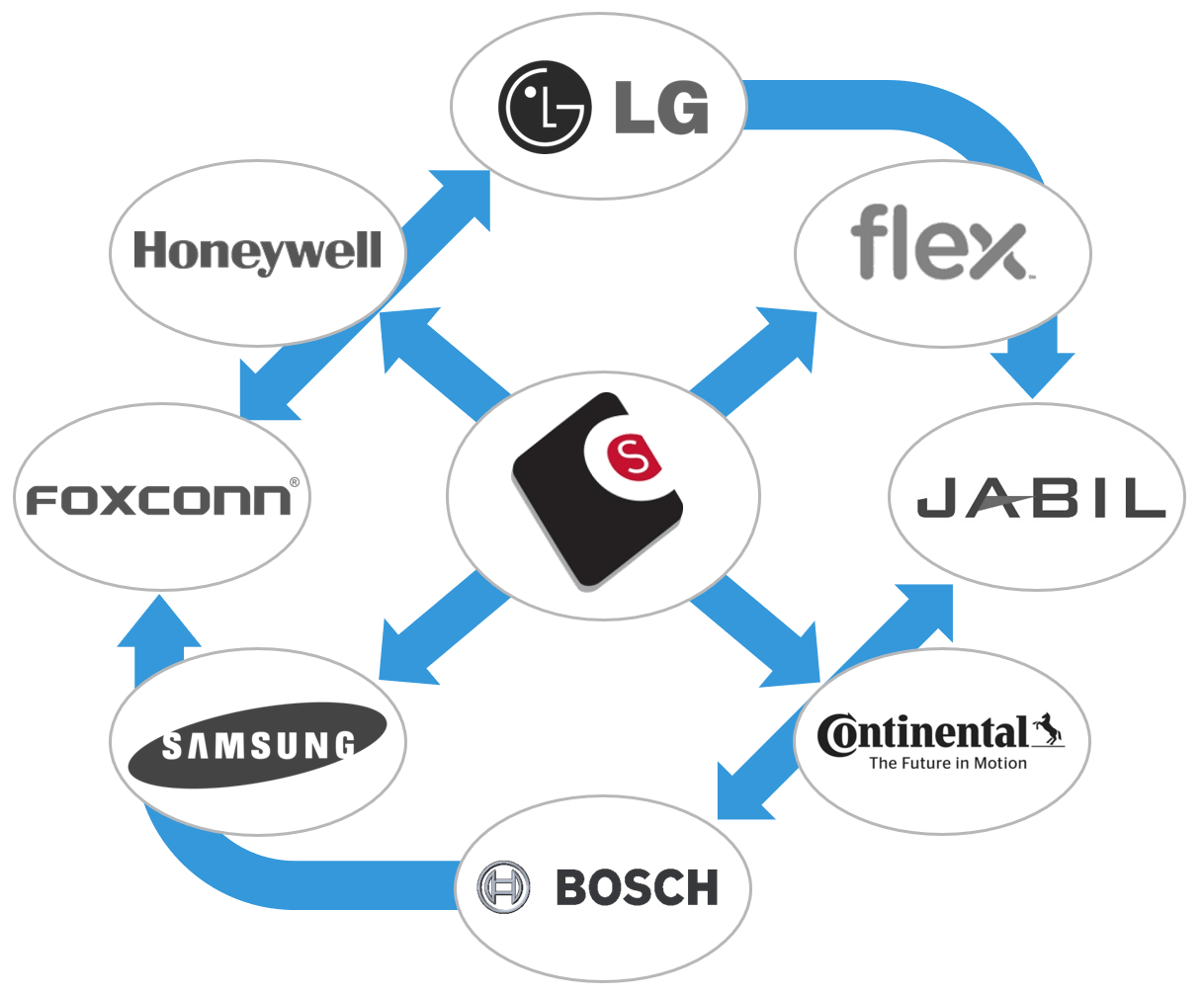

We act as the nexus between the world's largest manufacturers. Because every item in our system is fully traceable and verified, we can seamlessly feed stock from Jabil to Flextronics, or from Samsung to LG, or from Continental to Bosch. We also advertise your stock to our global network of buyers looking for brand-new, unused, traceable stock.

When you have excess, we sell it to this network. When you have a shortage, you can buy from this network with total confidence.

Ready to Sell Your E&O Stock?

There is no excuse for holding onto stock "just in case". The costs and risks are too high. As the saying goes, a buyer would rather be looking at the stock than looking for it.

Let us handle the "looking at it" part.

We can implement our InPlant™ system at zero cost to your business. We provide the technology, the process, and the global network. You just provide the stock.

Do not let another quarter pass with millions stuck on your shelves.