5 Strategies for Selling Excess & Obsolete (E&O) Stock in 2026

By Kenny McGee, CEO of Component Sense.

The $250 Billion Problem Hiding on Warehouse Shelves.

It is the industry’s most expensive open secret: electronic manufacturers are sitting on a mountain of cash they cannot touch.

The scale of the problem is staggering. According to a March 2023 report by global consulting firm Kearney, the high-tech industry is currently holding more than $250 billion in stock that is at risk of becoming excess or obsolete. For the average Electronics Manufacturing Services (EMS) provider, the picture is even more personal.

As I recently mentioned in a 2025 analysis for Circuitnet, most electronic manufacturers are holding at least 10% of their overall revenue in E&O stock.

In a post-pandemic market defined by the "bullwhip effect", where shortages rapidly flipped into massive oversupply, managing excess and obsolete stock is no longer just a warehouse housekeeping task. It is a critical financial strategy.

E&O should be viewed as pure cash.

Yet, for EMS providers, the path to selling this stock is blocked by unique hurdles: customer-owned inventory rules, inflated "standard costs", and a broker market that often does more harm than good.

This guide outlines the reality of the EMS inventory trap and details the strategies available to you, from basic scrapping to modern, data-driven recovery.

Why E&O is a Unique Challenge for EMS Companies

If you operate as an OEM (Original Equipment Manufacturer), E&O is simple: the stock is obsolete, so you sell it quickly, even at a loss, to clear the books.

For an EMS, however, the situation is often one of paralysis.

-

Customer Ownership: You are often holding stock that is ultimately owned by your customer.

-

The Cost Trap: You cannot sell it for less than cost without making a loss.

-

The Waiting Game: Managers often hold onto stock hoping to charge the full cost back to the customer later.

This creates a conflict of interest. While the warehouse team wants to clear space and the CFO wants cash, the account managers are terrified of taking a loss. The result is inaction. The stock sits, depreciates, and eventually becomes worthless.

Common (But Flawed) Methods for Selling E&O

When an EMS finally decides to act, they typically turn to one of three traditional methods. Unfortunately, in 2025, these methods rarely yield high returns.

1. The "Scrap" Method

This is the fastest route. You write it off, call a recycler, and it leaves the dock.

-

Pros: Immediate space clearing.

-

Cons: Zero financial recovery. It is a total loss.

2. The "Lot Buy"

You sell the entire pallet or warehouse section to a bidder for a fraction of the cost.

-

Pros: Low administrative effort.

-

Cons: You might get 5% to 10% of your value back. This destroys your margins.

3. The "Shotgun" Broker Approach (The Hidden Danger)

This is the most common mistake we see. An EMS company sends their E&O list to two, three, or sometimes ten different brokers hoping for a "bidding war".

Here is what actually happens:

-

Phantom Abundance: Buyers scan the market and see 20 different companies advertising the same part numbers in the same quantities.

-

Price Crashing: The market perceives a flood of supply, driving the price down immediately.

-

Broker Fatigue: Good brokers know that if 10 other people are working the list, their chances of closing the deal are low. They stop putting effort into marketing your stock.

-

Result: You effectively compete against yourself, driving down your own return.

This differs within an OEM business. As soon as an OEM determines that the stock is obsolete to their requirements, they are prepared to dispose of it quickly, even if it means reducing the book value to achieve this. This makes logical sense in an OEM arena.

Modern Strategies for Maximum Recovery

To recover value in today's market, you must treat E&O as an avenue to recoup cash (working capital) rather than garbage.

4. Consignment Partnerships

Moving stock to a partner’s warehouse can be an effective strategy. It clears your floor space immediately. However, you must ensure you have total transparency. If you lose visibility of your stock, you risk losing control of the sales price.

5. Data-Driven "InPlant" Solutions

The most effective modern strategy is to integrate a partner directly into your Material Requirements Planning (MRP) system.

How it works: Instead of sending static Excel lists, which are often outdated by the time they are emailed, a partner integrates with your live data. This usually involves using an on-site operator or tablet system.

-

Live Data: The partner knows precisely what is on the shelf, down to the brand and date code.

-

Internal Part Number Decoding: The system automatically maps your internal codes to manufacturer part numbers, making them instantly marketable globally.

-

High Recovery: Because the data is trusted and the stock is verified, it can be sold at a premium. This often allows for the recovery of 100% of the original cost

The InPlant™ Journey: Turning Excess and Obsolete Stock into Daily Cash Flow

The InPlant™ system is Component Sense's unique solution, developed to address the complexities of E&O resale within an EMS or OEM plant. It's not just software; it's a new operational process built around your business.

Phase 1: Alignment and Setup

Our journey with you begins not with technology, but with your people. We visit your factory to meet with a diverse range of stakeholders, including materials and purchasing personnel, senior management, operations personnel, and business unit managers. Why? Because we need to understand the limitations and ensure everyone is on the same page.

-

Solving the Standoff: We know the Materials Manager is keen to reduce E&O (it's a KPI), but the Buyer would rather "be looking at the stock than looking for it"—preferring to stockpile "just in case." We tailor the solution to accommodate these needs, ensuring a unified approach to releasing stock quickly and safely.

-

Zero-Cost Implementation: It's an extremely simple system that works on an iPad which we provide, meaning there is no cost to your business.

Phase 2: Live Data & Operational Efficiency

The biggest barrier to resale is poor data, specifically internal part numbers and constant stock fluctuation. InPlant™ solves this with live data integration.

-

MRP Integration: Our system is designed to take live data straight from your MRP system (whether SAP or another system) daily. We typically run reports overnight so you have fresh data each morning. This immediately eliminates the "possible part number" problem.

-

On-Site Verification: We then place an operator (either an employee of ours or yours—a single person with basic warehouse experience is often enough for a multi-billion dollar site) to manage the system.

-

Smart Stock Tracking: This is where we create efficiencies. InPlant™ tracks stock movements within your company. If a product goes out to production and then comes back into stock, we can monitor it. This means we can prevent a further stock check because we already know it's the same part and date code, keeping your list constantly marketable.

Phase 3: The Financial Win (100% Recovery)

Now that we have clean, reliable data, the stock is ready to sell. Our financial model is designed to overcome the "no loss" barrier for EMS companies.

-

Low Margin Advantage: We are not physically buying stock until we have sold it, allowing us to work on much lower margins than a traditional broker.

-

Guaranteed Return: Our goal is to give you at least 100% of your cost back. Because a large EMS is buying well below the general market price, we can often sell your part at its full cost plus a margin, perhaps 10% PPV (Positive Price Variance), and still undercut the market price that a more modest company would pay. This unlocks stock that was previously unsaleable due to restrictive pricing.

-

Risk Mitigation: The system allows you to act quickly. If forecasts fall or a customer goes bust, you need to get rid of that stock instantly. InPlant™ provides the tool to do this, turning what could be millions of dollars of risk into cash recovery.

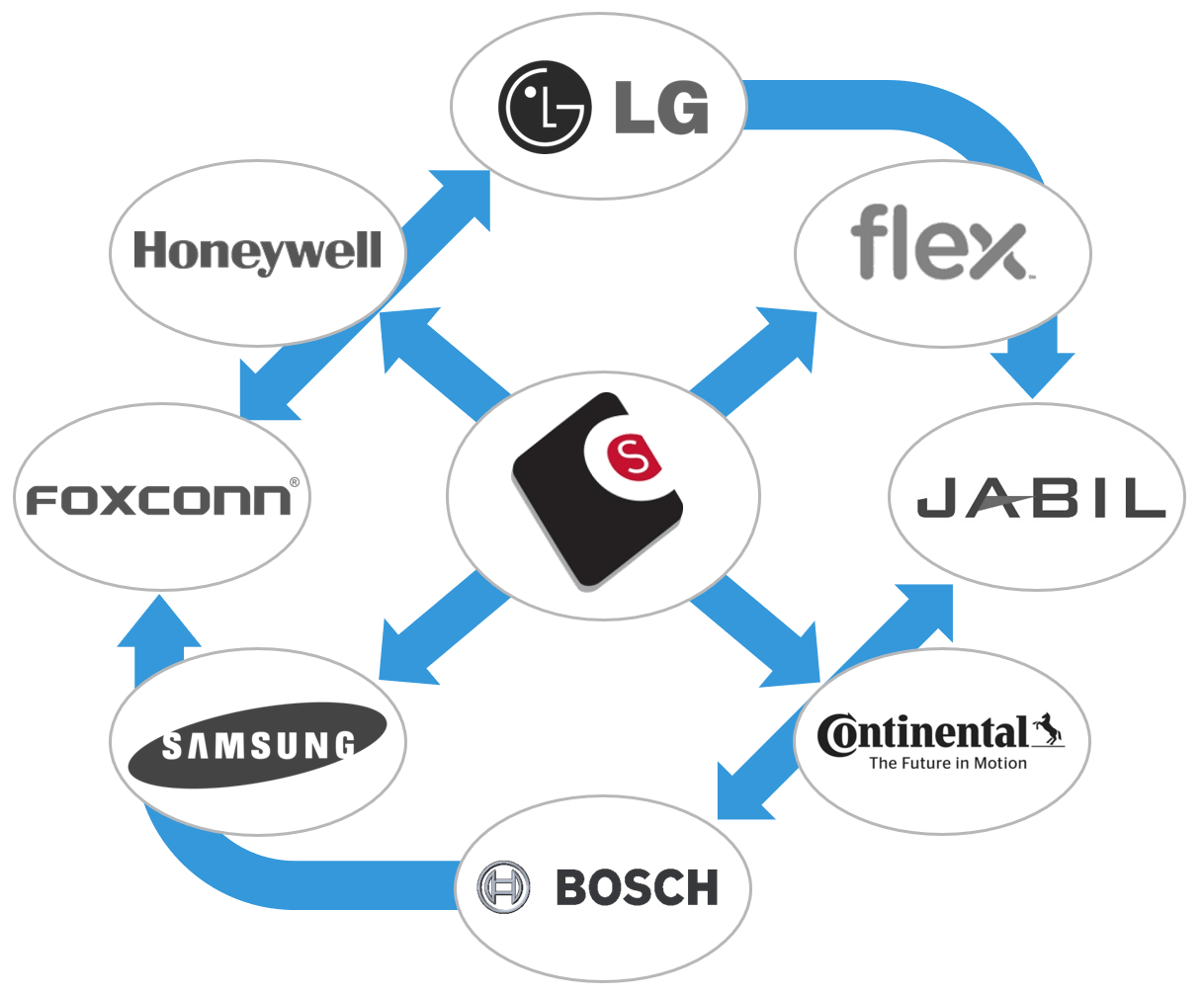

- Creating a Linchpin: As we add more factories, we create a superb network of trusted suppliers with full traceability. We manage hundreds of millions of dollars of fully traceable stock, acting as the linchpin to feed stock between large manufacturers.

-

Seamless Exchange: Essentially, we can feed stock, for example, from Jabil to Flextronics or Continental to Bosch and vice versa. When you experience a shortage, this network of companies provides you with instant access to fully trusted, traceable components.

Watch this video to learn about our InPlantTM system.

Contact us today about our InPlantTM system, which allows us to start selling your E&O stock and turn it back into cash.