2026 Electronics Supply Chain: 5 Resolutions for Resilience

If the last few years were defined by "stabilisation," a desperate attempt to return to normal after the shocks of the early 2020s, then 2026 will be defined by something far more demanding: Execution.

The stakes have never been higher. According to recent data from Gartner, global semiconductor revenue is projected to surge to $717 billion by the end of 2025 and continue its double-digit growth trajectory into 2026. This growth is being driven by a fast-growing demand for AI-capable hardware, High Bandwidth Memory (HBM), and automotive electrification. These trends are accelerating the industry toward the anticipated trillion-dollar valuation that defines the strategic opportunity of the next few years.

But there’s a catch to this trillion-dollar opportunity. While demand explodes, the constraints on how we meet that demand, including environmental regulations, geopolitical fragmentation, and resource scarcity, are tightening. The strategies that worked in 2024 are insufficient for the compliance and efficiency realities of 2026.

For Chief Supply Chain Officers (CSCOs) and procurement leaders, the resolution for the year ahead cannot simply be "do more." It must be "do better." Here are the five strategic resolutions that will define the leaders of the 2026 electronics supply chain landscape.

Resolution 1: Data Visibility and Inventory Accuracy: Eliminating Operational Blind Spots

The Strategic Priority: Operational Efficiency Through Visibility

For too many OEMs and EMS providers, the greatest threat to organisational efficiency is internal data blindness. The root cause of costly obsolescence is often not the market, but the lack of real-time visibility within their own systems.

We have seen the pattern repeatedly: a warehouse runs on an MRP system that is theoretically accurate but practically flawed. "Bad data," inaccurate part numbers, outdated lifecycle codes, or ghost inventory create a massive blind spot. Inventory teams often fail to realise a component has become "slow-moving" or "obsolete" until it has been sitting on the shelf for three years, gathering dust.

Even worse, they frequently miss the opportunity to monetise "Active Excess," stock may currently be in high demand globally, but is sitting idle in their own facility because the system hasn't flagged it as saleable surplus.

The 2026 Reality Check: The "Data Gap"

The speed of the market in 2026 means that the window of opportunity to recover value from inventory is shrinking. If your tracking is manual or disconnected, you are effectively driving blind.

You might be holding hundreds of millions of units of a high-value sensor that is currently experiencing a global shortage. Because your data doesn't flag this as "Active Excess" in real-time, you miss the window to sell it at peak value. By the time you conduct a manual stocktake the following year, that part might be technically obsolete and no longer worth as much.

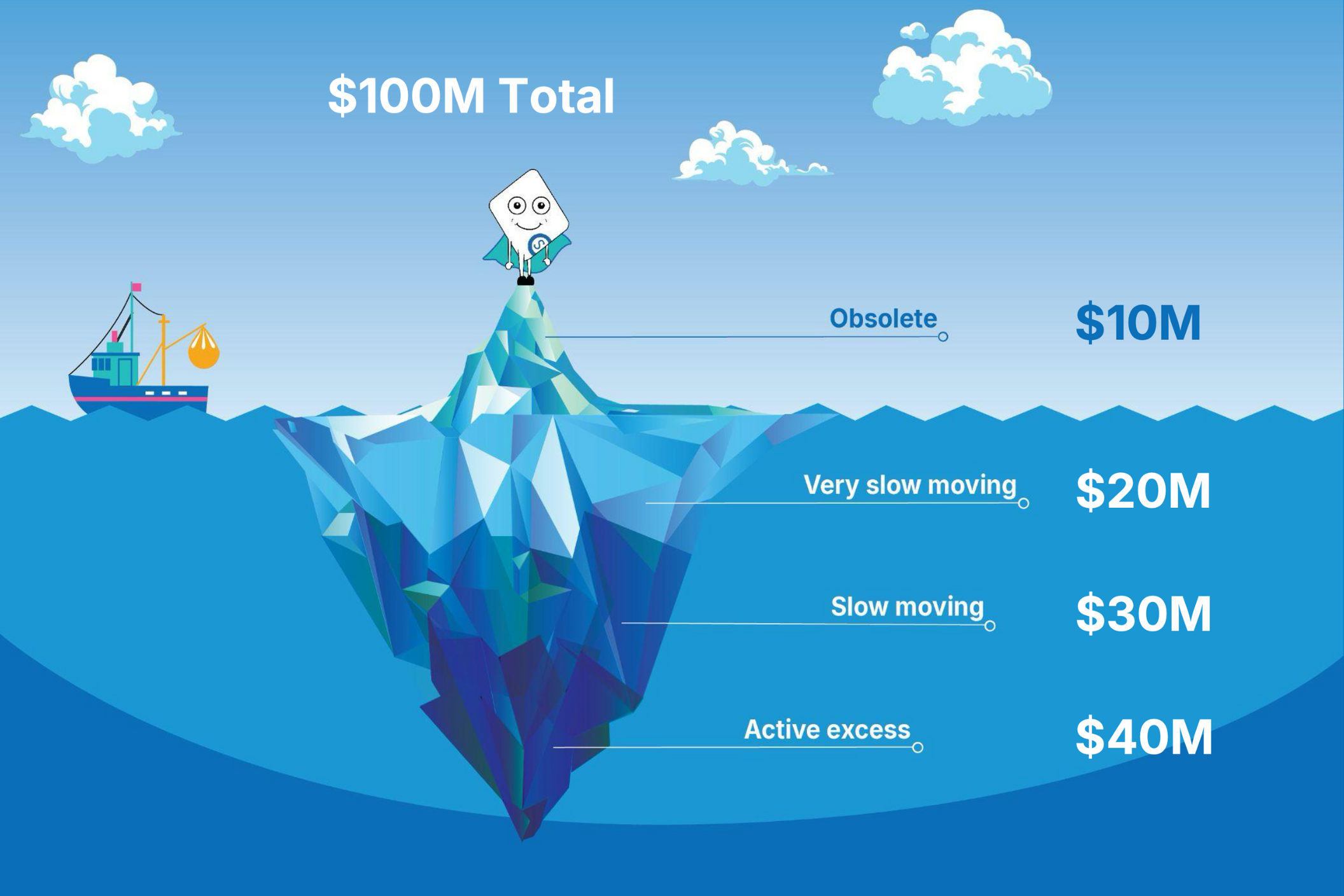

The "Silent" Cost: A significant percentage of inventory written down as "Obsolete" only reached that status because bad data hid it for too long. It started as " Active Excess," transitioned to "Slow Moving," and finally to "Obsolete," all while the MRP system remained silent. For example, if your business has an annual revenue of $1 billion, you are likely to be sitting on $100 million worth of excess inventory.

- The Tracking Penalty: Inaccurate tracking leads to "Phantom Inventory," where procurement re-orders parts they already have because they cannot "see" them in the system.

- The Opportunity Cost: Every day a marketable part sits unidentified as excess, its market value depreciates.

The Resolution for 2026: Automate Your Visibility with InPlant™

This year, resolve to eliminate the "spreadsheet lag." Operational efficiency means knowing precisely what you have, what you need, and what excess you can sell, in real-time. By combining our automated InPlant™ software with our expert industry knowledge, we can help you identify excess at the earliest possible stage.

By dealing with excess stock early, we can resell newer components and therefore are more likely to achieve a return on cost or even make a profit. We advertise your excess to our global network of buyers and help you recover 100% of costs.

- The Shift: Move from "Static Snapshots" (annual stock takes) to "Real-time data Integration”.

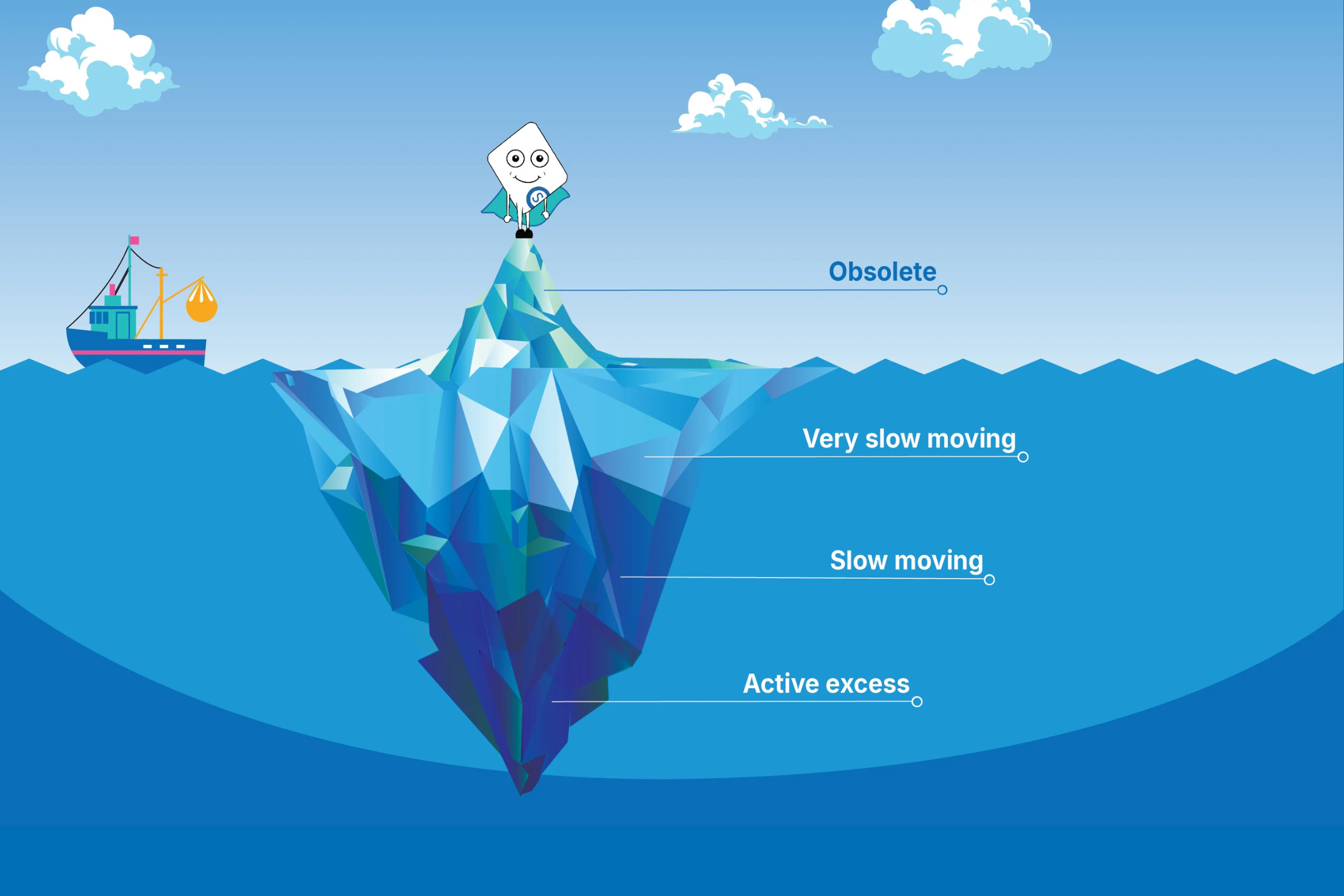

- The Action: Stop relying on manual uploads to assess your inventory health. Implement automated solutions, such as InPlant™, that integrate directly with your MRP. InPlant™ acts as a continuous diagnostic tool, scrubbing your data to help you identify and classify stages of excess for redistribution:

- Active Excess: Newly surplus parts with high demand and up-to-date technology. Move them early, and you gain the best chance of recovering cost price while avoiding years of unnecessary carrying costs.

- Slow-Moving: Stock with no movement for 6–18 months, quietly tying up cash and shelf space. With strong demand for newer date codes, listing this inventory early unlocks value before depreciation begins to set in.

- Obsolete stock: Components with no movement for over two years and no future use planned. These parts often carry old date codes yet remain valuable for legacy equipment, repairs, and hard-to-source applications.

- The Goal: Achieve 100% Data Accuracy. When you trust your data, you stop over-ordering "just in case" and start monetising your excess "just in time."

Resolution 2: Excess Inventory: Turn Your "Waste" into Revenue

The Strategic Priority: Driving Profitability Through the Circular Economy

Historically, the electronics industry has operated on a linear model: extraction, manufacturing, usage, and disposal. In this outdated framework, excess inventory was viewed as a shameful secret, a liability to be hidden, written off, and eventually shredded. The data visibility achieved in Resolution 1 immediately reveals the scope of this financial and environmental inefficiency.

In 2026, scrapping usable inventory is no longer just a waste of money; it is a failure of corporate governance.

The 2026 Reality Check

We are approaching a regulatory cliff. The EU Digital Product Passport (DPP) is moving from a theoretical framework to a pilot reality, particularly for batteries and industrial electronics. By late 2026 and 2027, products entering the European market will be required to provide verifiable data on their circularity and carbon footprint.

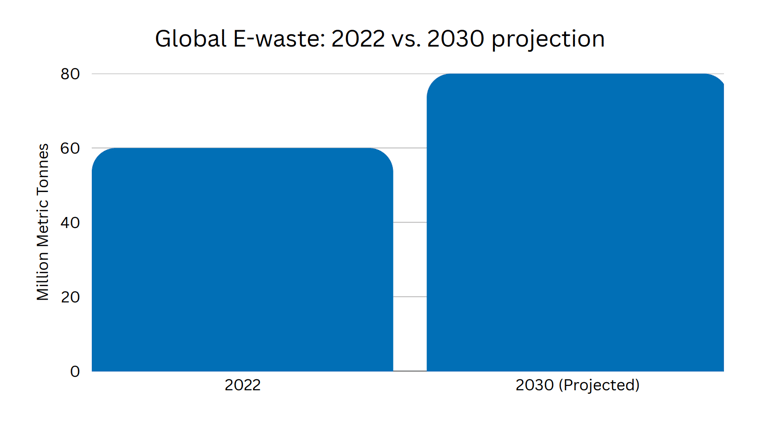

Simultaneously, the sheer volume of waste is untenable.

The world generated over 60 million metric tonnes of e-waste in 2022, which contained billions of dollars' worth of recoverable gold, copper, and critical rare earth elements. The UN reports that this number is projected to rise to 80 million metric tonnes by 2030.

The Data: The "recommerce" market (act of selling or reselling excess stock) is growing 12 times faster annually and is expected to reach USD 310.5 billion by the end of 2029. This signals a massive shift in buyer psychology. OEMs are no longer afraid of "open market" stock; they are actively seeking it to mitigate shortages and lower their costs.

For example, if an OEM faces a 52-week lead time from a primary distributor, actively seeking verified excess stock allows them to meet immediate production goals and maintain customer loyalty.

The Resolution for 2026: Prioritise Redistribution Over Recycling and Scrapping

Recycling is often touted as the gold standard of sustainability, but in the hierarchy of circularity, it is actually a last resort. Melting down a pristine microcontroller to recover a few cents of copper destroys the immense amount of energy and embodied carbon used to manufacture it.

- The Shift: View your warehouse not as a storage facility, but as a liquidity hub.

- The Action: Partner with circular supply chain experts like Component Sense, who can audit your excess inventory, authenticate it, and reintroduce it to the global market.

- The Goal: Adopt a "Zero-Scrap" policy for usable components. At Component Sense, we have demonstrated that companies adopting this model can recover significant capital while preventing tonnes of CO2 emissions. In 2026, sustainability must be profitable to be scalable.

Resolution 3: Map Your Scope 3 Emissions - Report Real Data

The Strategic Priority: The "Transparent Pipeline"

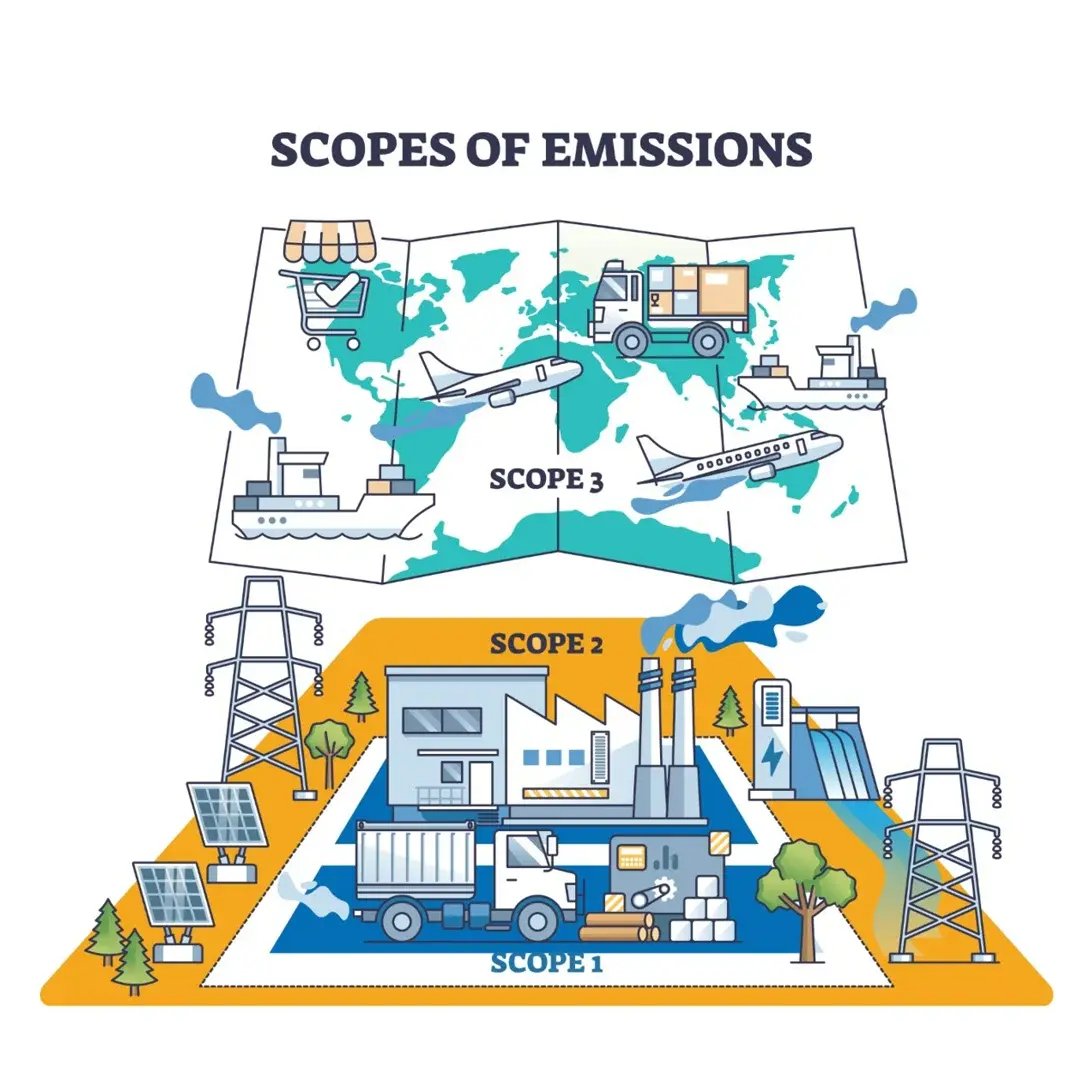

For the last five years, corporate sustainability reports have been filled with estimates, averages, and "spend-based" calculations. Companies have comfortably reported their Scope 1 and 2 emissions (their own operations) while largely ignoring Scope 3 emissions (those from the supply chain).

The 2026 Reality Check

Regulatory frameworks such as the Corporate Sustainability Reporting Directive (CSRD) in Europe and SB 253 in California are forcing the issue. These laws compel large companies to report emissions across their entire value chain.

The challenge is that for most electronics OEMs, nearly 70% to 90% of their total emissions profile lies in Scope 3, specifically in the energy-intensive mining and wafer fabrication stages, which are managed by Tier 2 and Tier 3 suppliers.

The Consequence of Opacity: If you are relying on industry averages to calculate your carbon footprint in 2026, you are exposing your organisation to litigation risk and accusations of "greenwashing." Investors and B2B customers are increasingly demanding primary data. They want to know the specific carbon intensity of the factory, say in Taiwan, not the average carbon intensity of the Taiwanese grid.

The Resolution for 2026: Digitalise the Sub-Tier Relationship

Transparency is no longer a "nice to have," it is a licence to operate.

- The Shift: From "Supplier Management" to "Value Chain Collaboration."

- The Action: Launch initiatives to collect primary data from your strategic suppliers. Incentivise them to share their energy data by offering longer-term contracts or preferred status.

- The Goal: Establish a "Glass Pipeline" where you have visibility beyond the distributor, all the way to the manufacturer. You cannot reduce what you cannot measure. By identifying the carbon hotspots in your supply chain, you can make informed decisions, such as switching logistics modes or changing suppliers, that actually move the needle.

At Component Sense, we’ve partnered with logistics company DSV, who also share our passion for sustainable supply chains. DSV has raised their sustainability ambitions and is committed to reaching net zero emissions across its operations by 2050. To achieve this, they provide Green Logistics solutions.

Resolution 4: Diversify to De-Risk

The Strategic Priority: Diversify your supply sources

The era of hyper-globalisation, where a single factory in one region could supply the entire world, is effectively over. We have entered the era of "Regional Sovereignty."

In 2026, the geopolitical landscape remains fragmented. Trade tariffs, export controls on advanced semiconductors, and the logistical vulnerabilities exposed by conflicts in the Red Sea and other corridors have made single-source dependency almost impossible.

The 2026 Reality Check

The investments made in the early 2020s, such as the US CHIPS and Science Act and the European Chips Act, are finally bearing fruit. New fabrication plants in Arizona, Ohio, Germany, and Japan are coming online or nearing completion. Simultaneously, Southeast Asia (Vietnam, Malaysia, India) has matured from a low-cost assembly hub into a sophisticated ecosystem for advanced packaging and testing.

The Resilience Metric: Resilience in 2026 is measured by how companies incorporate redundancy into their manufacturing processes. It is not enough to have a second source; you must have a geographically distinct source.

The Resolution for 2026: Adopt a "Multi-Supplier" Strategy

The goal is not to abandon established hubs but to create independent supply networks that can survive a global shock.

- The Shift: From "Lowest Landed Cost" to "Total Value at Risk." This involves electronic manufacturers abandoning the pursuit of the absolute cheapest price for a component in favour of assessing the holistic cost of potential failure.

- The Action: Audit your BOM for single-source dependencies in geopolitically sensitive regions. Qualify alternative parts that are manufactured in different trade zones.

- The Goal: Create a supply chain that can serve your customers in various markets by partnering with companies that make it easy to fulfil your BOM even in times of instability and supply chain disruptions.

Are you preparing your BOM for 2026? Let’s help you fulfil it. Submit your BOM here.

Resolution 5: Remember the "People" in Sustainability

The Strategic Priority: Social Responsibility as Resilience

Ultimately, a truly sustainable supply chain prioritises the well-being of people, not just the planet. As we focus heavily on carbon and silicon in 2026, we must not lose sight of the biological component of our supply chain: the workforce.

The 2026 Reality Check

The International Labour Organisation (ILO) has flagged climate change as a significant threat to worker safety. With 2024 and 2025 breaking heat records, factory and logistics workers in key manufacturing hubs (South Asia, Latin America) are facing increased risks of heat stress.

Simultaneously, the integration of AI is accelerating the automation gap. Routine tasks (like component sorting and simple assembly) are being targeted by robotics, threatening job displacement in EMS facilities and creating a severe skills mismatch. This forces procurement teams to manage a workforce that is rapidly changing both in location and required expertise.

The Resolution for 2026: Invest in the "Bionic" Workforce

Sustainability includes the sustainability of your labour force. If your workers are unsafe or burnt out, your supply chain is fragile.

- The Shift: From "Labour Arbitrage" to "Labour Augmentation."

- The Action: Invest in automation that supports human workers rather than just replacing them. AI tools like InPlant™, can reduce mental fatigue for procurement teams. Additionally, enforce strict social audits regarding heat mitigation and safety protocols with your suppliers in regions with higher temperatures.

- The Goal: Build a reputation as a "Great Place to Work”. In 2026, companies that attract the best procurement managers and logistics operators will be those that offer the best tools and the safest environments.

The Bottom Line for 2026

The resolutions for this year are not disconnected goals; they are an interconnected ecosystem.

You cannot achieve Operational Efficiency (Resolution 1) without better data. You cannot achieve Circularity (Resolution 2) without better data. You cannot achieve Scope 3 Transparency (Resolution 3) without, you guessed it, better data.

The common thread running through 2026 is Intelligence. The companies that succeed in 2026 will be the ones that stop viewing sustainability as a "compliance cost" and start viewing it as an "efficiency engine."

At Component Sense, we believe that the supply chain of 2026 is an opportunity to build a legacy. We are committed to helping the industry navigate this transition by turning the "waste" of the past into the "resource" of the future.

Will you lead the change, or be chased by it?

The tools exist. The data is clear. The year of execution is here.

Ready to Turn Resolution #2 Into Reality?

Don't let your excess inventory become a liability in 2026. Connect with Component Sense today to learn how our InPlant™ solution can help you redistribute your excess stock, recover capital, and build a zero-waste supply chain.